Applications of the Option Pricing

Paradigm to Insurance

by

Michael Wacek

Discussion by

Stephen Mildenhall

CNA Re, Chicago IL

Contents

What is Black Scholes?

Black Scholes is a mathematical theorem: a statement that certain

conclusions follow from certain premises

- Determines price of European call option on a stock

- Call Option is the right, but not obligation, to buy at a pre-determined

exercise or strike price

- European: can only be exercised at expiration

Assumptions

- Stock price:

- Follows a "geometric Brownian motion"

- Instantaneous

stock returns are normally distributed

- No stock dividends are payable during life of the derivative

- Continuous time trading

- Infinitely divisible securities (e.g. can buy 0.1234 a stock)

- Ability to borrow and lend at a fixed risk free rate of interest

r

- r is fixed regardless of duration

- No restrictions on short selling; full use of proceeds

- No transaction costs or taxes

- No arbitrages

- Whether Black Scholes is true in the "real world"

depends on whether the premises hold in the real world

Black Scholes is very complete pricing Paradigm

- Gives price and an explicit way to "hedge" (manufacture)

the product for the indicated price by trading in the underlying stock and

bonds

- Like an insurance pricing model plus a reinsurance structure

guaranteeing results!

- Regardless of state of reinsurance market

Black Scholes Pricing and Market Pricing

|

Ex Price

|

Intrinsic

Value

|

Market

Price

|

BS

|

Pct Error

|

Actuarial

|

Volume

|

|

750

|

169.77 |

186 |

181.06

|

-2.7% |

201.99

|

714 |

|

805

|

114.77 |

135 |

130.90

|

-3.0% |

150.55

|

3 |

|

890

|

29.77 |

67 1/2 |

66.90

|

-0.9% |

82.04

|

10 |

|

900

|

19.77 |

64 |

60.88

|

-4.9% |

75.32

|

6 |

|

910

|

9.77 |

59 1/4 |

55.22

|

-6.8% |

68.93

|

102 |

|

930

|

0 |

44 1/4 |

44.96

|

1.6% |

57.18

|

3,291 |

|

935

|

0 |

41 3/4 |

42.62

|

2.1% |

54.46

|

5 |

|

940

|

0 |

42 1/2 |

40.37

|

-5.0% |

51.83

|

264 |

|

950

|

0 |

36 1/4 |

36.12

|

-0.4% |

46.83

|

14 |

|

960

|

0 |

31 1/2 |

32.20

|

2.2% |

42.17

|

2 |

|

990

|

0 |

21 |

22.37

|

6.5% |

30.20

|

5 |

|

995

|

0 |

20 |

20.99

|

4.9% |

28.48

|

107 |

|

1025

|

0 |

11 |

14.07

|

27.9% |

19.71

|

7 |

|

|

|

|

|

|

|

- S&P 500 European Calls September 15, 1997

- S&P closed at 919.77

- Risk free rate of interest 5.12%, discount factor 0.9868

- 95 days to expiration

- Actuarial pricing assumes growth rate on stocks 15%

pa (13.98% compounded continuously) discounted at risk free rate

- Standard Deviation of stock returns: 23.5% annually

- Errors +/-7% over a large range except for one, very

out of the money call

- Last trade on may have been well before close

- Oh, for such a good way to price GL!

Insurance Interpretations

Aggregate Stop Loss Likened Call Option

- Agg stop "attaches" at a certain loss ratio

and pays the excess of actual losses over the attachment

- Agg stop with a limit = difference of two agg stops

with different attachments

- Call option has an "exercise" price and pays

the excess of the final stock price over the exercise price

- Ignore niceties of time and payout patterns: assume

agg stop settles in full T years from now with a single payment

- Could argue that agg stops are more like swaps than options

How do you price an Aggregate Stop Loss?

- S = aggregate loss random variable

- Current best estimate of losses at

expiration, T years from now

- k = attachment point

- Pure Premium = E[ max(S-k, 0) ]

- PV Pure Premium = e-r'TE[ max(S-k, 0) ] for some

discount rate r' per year

- Premium = ???

- Example

- S ~ Lognormal(m, s)

- Mean of log(S) is m and standard

deviation is s

- Selected discounting interest rate r'

- Discounted pure premium can be determined using Part 1 calculus

em+s2/2-r'T

F((ln(1/k)+(m+s2))/s) - e-r¢Tk F((ln(1/k)+m)/s)

- See appendix for details

- F is the cumulative distribution function of the standard normal distribution

An Actuarial Call Option Price

Black Scholes assumes stock prices follow a Geometric Brownian

Motion

- Changes in stock prices over a short period of time are approximately

normally distributed

- DS / S = mDt + sZÖDt, where Z is a standard normal random variable

- Mean return in small time period Dt is mDt

- Variance is s2Dt

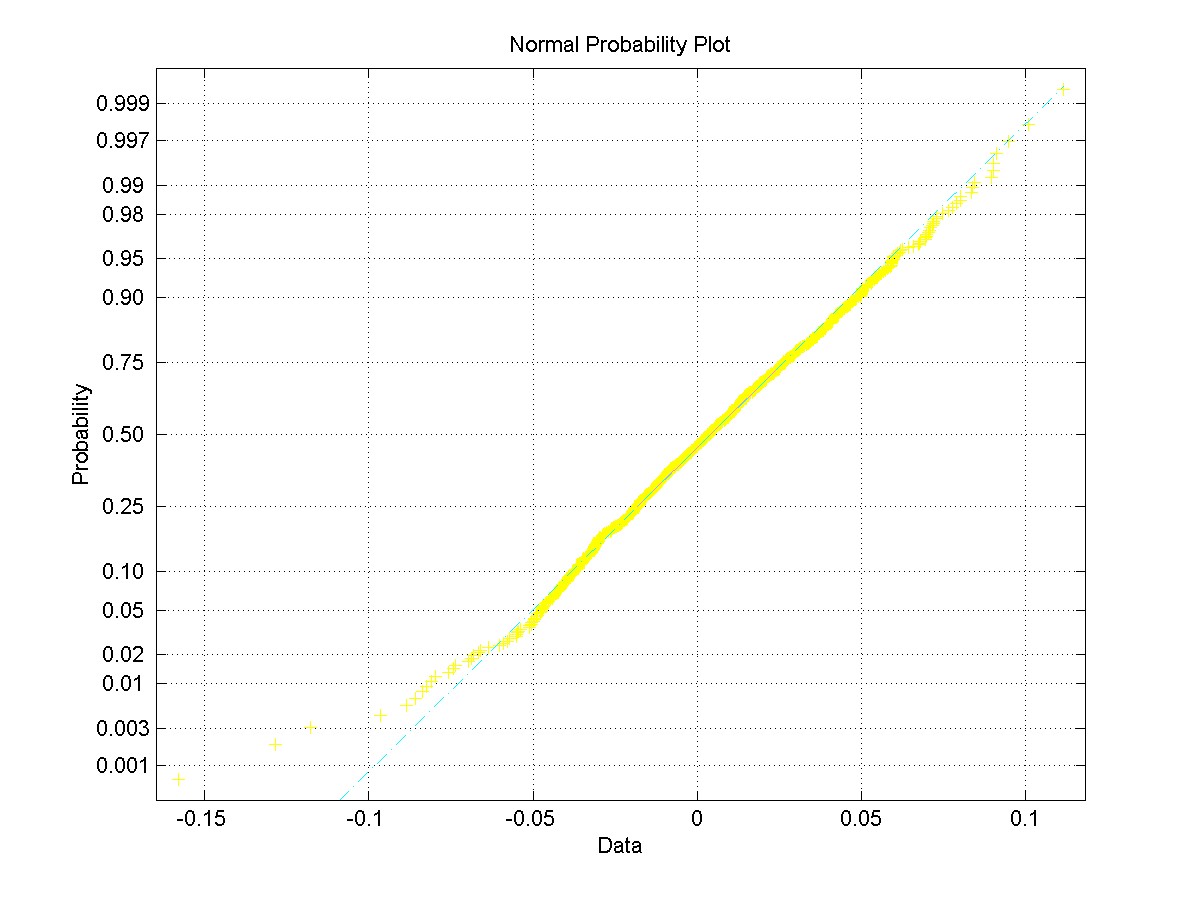

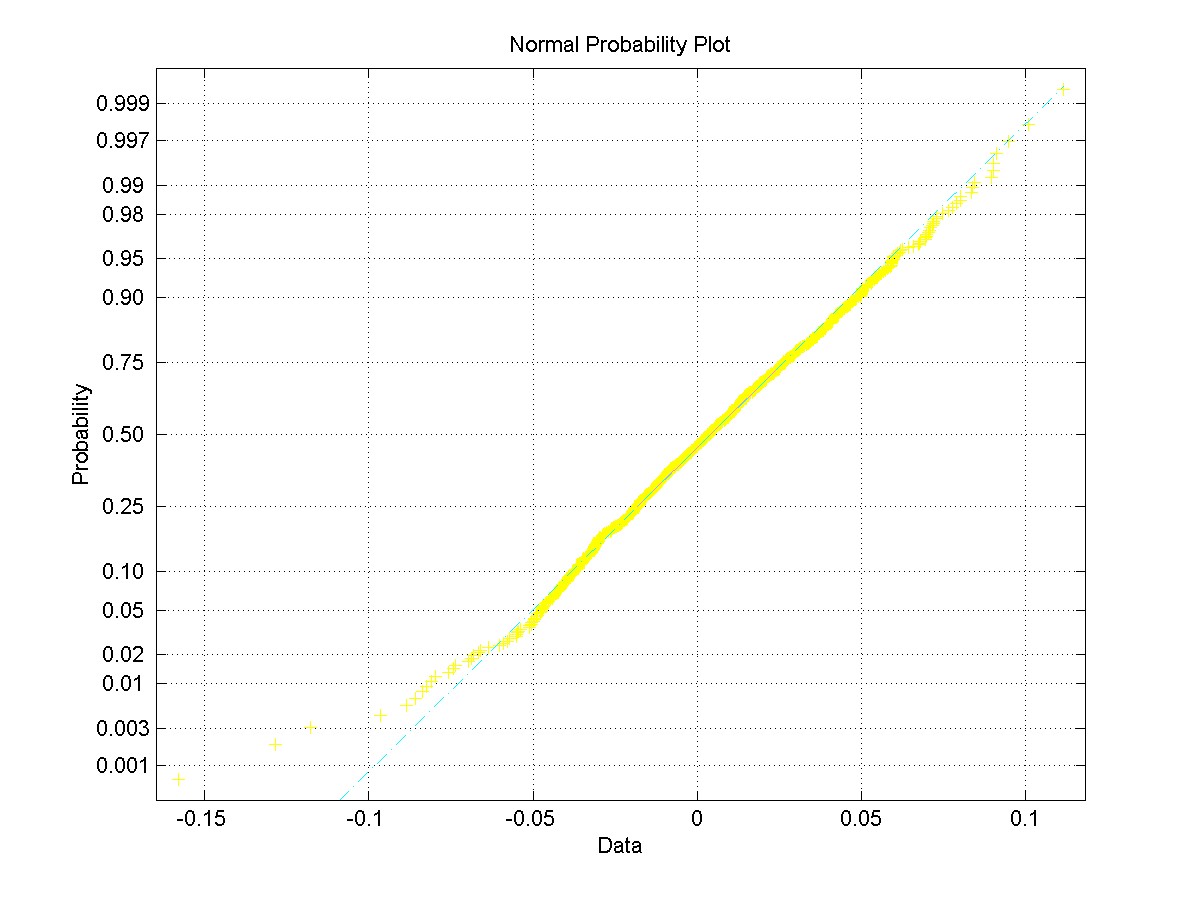

- Is this reasonable? Below is a normal probability plot for

Dell stock daily returns 1/2/97 to 2/9/00

- Note problems with fit in extreme left tail

- Indicates trouble with assumptions for deeply in and

out of the money options (volatility smile)

- GBM implies that T years from now the stock price ST

is lognormal and

ln(ST/S0) ~ N((m-s2/2)T,

sT1/2)

Estimating Parameters

- Mean m: CAPM, historical record

- Standard deviation s: Historical

record, last thirty days returns.

- Finance has the data of an actuary's dreams!

- Discounting Interest Rate r': COTOR Comprehensive

Study, Zen Enlightenment

- Can now apply our agg stop pricing formula:

- e-r'TE[ max(ST-k, 0) ] = e-r'T

S0 E[ max(ST/S0 - k/S0, 0) ]

- m ¬ (m-s2/2)T

- k ¬ k/S0

- s ¬ sÖT

e(m-r¢) T S0 F(ln(S0/k)+(m+s2/2)T/sÖT) - e-r¢T k F(ln(S0/k)+(m-s2/2)T/sÖT)

- This formula appeared in a Samuelson paper published in the

1960's following the same logic used here

- Still issue of converting from discounted pure

premium to premium

- Actuarial Price in table assumes r=r' in above formula

Why Black Scholes is Surprising

Compare Black Scholes result with formula above

| Act: |

e(m-r¢) T

|

S0 F(ln(S0/k)+(m+s2/2)T/sÖT)

|

- |

e-r¢T k F(ln(S0/k)+(m-s2/2)T/sÖT) |

| BS: |

|

S0 F(ln(S0/k)+(r+s2/2)T/sÖT)

|

- |

e-rT k F(ln(S0/k)+(r-s2/2)T/sÖT)

|

Implies

- Black Scholes assumes m = r: stock

earns risk free return!!!

- Black Scholes assumes r' = r: discount at risk free rate!!!

Interpretation

- Option Interpretation: Call option price is independent of

expected appreciation (depreciation) of particular stock during contract period

- Insurance Interpretation: Agg stop price is independent of expected losses;

only volatility matters

- All cash flow discounted as though they are risk free

How can this be?

Risk in finance is an element of stochastic behavior

in future prices

- In GBM it is the term sZÖDt, creates "wiggles"

- Risk Free: locally deterministic price, like bank CD or bill in fixed interest

rate environment

Return above risk free rate required when future value

contains element of risk

- Each source of uncertainty commands a price, called market

price of risk

- Different stocks, oil futures, insurance derivatives

KEY POINT: Between underlying stock, bond and option there

is only one source of stochastic behaviour (uncertainty)

- Option and stock prices are instantaneously perfectly correlated

- Plausible: stock price and call price must move together

- Portfolio mixing the two in the right

proportions would be risk free

- Right proportion is dC/dS =: d < 1, hence "delta" hedging

- Law of one price implies gives option price

Basis of Option Pricing Paradigm

- Write an option and combine with portfolio of stocks and

bonds to remove all risk (wiggles)

- Cost of option = cost of setting up initial portfolio of stocks and bonds

provided no more cash flows required from trading

- Black Scholes paradigm shows price does equal cost of hedging portfolio

- Hence Black Scholes is a complete pricing paradigm

- Hedging portfolio "manufactures" option

- Option Pricing Paradigm does not rely on the law

of large numbers

- Obviously horrendous correlations exist in

portfolio of equities and options!

- Cost of initial portfolio independent of m, expected

return on stock

- Leads to notion of risk neutral valuation: can assume any convenient risk

preferences

- Risk neutral assumption: stocks earn risk free return hence m

= r

- Risk free portfolios earn the risk free return, hence r = r'

- Classic example of binary stock price model and explicit

hedging strategy is given in discussion

Cox and Ross

Investor's preferences and demand conditions in general

enter the valuation problem only in so far as they determine the equilibrium

parameter values. No matter what preferences are, as long as they determine

the same relevant parameter values, they will also value the option identically.

In the Black-Scholes case ... the only relevant parameters for the pricing problem

are r and sigma. To solve [for the price], then, we need only find the equilibrium

solution ... in some world where preferences are given and consistent with the

specified parameter values; the solution obtained will then be preference free.

Approach hinges on existence of traded underlying security

- Does not exist with many insurance products

- Work around possible in some cases

- Two options on same underlying (whether traded or not) share

a single source of uncertainty

- Same arguments used in Black Scholes imply there must be

a relation between prices of options at different strikes and expirations

- Could possibly be used to get constraints on Cat Options

where there is a single source of uncertainty

Fine Print on No-Arbitrage

No-Arbitrage means "no free lunch"

- No-arbitrage implies assets with equivalent cash flows command

the same price

- Alternative risk and packaging of risks should not lower

price - unless there is less coverage

- A model with arbitrages is not viable as a model

of market prices

since

- Agents would immediately act to change

prices!

Financial markets allow long and short positions

- If combinations A and B are equivalent

but not equally priced, the over-priced combination would be shorted by investors

who would buy B with the proceeds to produce an arbitrage profit

A geometric Brownian motion stock price process allows arbitrage

possibilities

- Doubling strategy

- Restrictions on the amount borrowed or on short sales needed

- No arbitrage is a consequence of the model framework not an assumption

Questions and Answers

Appendix

Full Discussion

Formulae typeset using LaTeX and translated from TeX by TTH,

version 2.34.